New Build Investment Property Masterclass: Chapter 12 - Basic financial model of a development project

Basic financial model of a development project

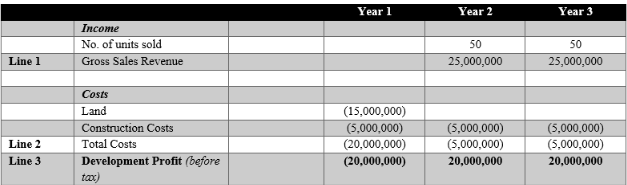

IBelow, I have set out a basic residential development in terms of the cash flow it generates. I have simplified the cash flow to make it easier to understand. However, from an accounting perspective, the model below is not realistic because there are differences in terms of when costs are recognised from a cash and an accounting perspective.

Kingsley Tower consists of 100 apartments. Let's assume the following:

- Development time - 3 years

- Average Sale Price - £500,000

- Land Costs - £15 million

- Construction Costs - £15 million

- Construction - paid in three annual instalments of £5 million each

- Sales - 50 p.a. in years 2 & 3

In this simple example, I have not taken into account any financing costs, or any other costs associated with the development. Nor have I considered any timing differences from a collection of cash perspective.

Table 2.1: Kingsley Tower, simple development model

The project generates a net income of £20,000,000 that is calculated by subtracting land and construction costs of £30,000,000 from a gross income of £50,000,000. Therefore, the development has generated a development profit of £20,000,000.

When thinking about development and undertaking financial modelling, developers will refer to a Gross Development Value, or a project’s GDV. The GDV is simply the total income realised in Line 1 of the model above, i.e., the forecast gross income of the sum of all the apartments, together with any other items sold such as car parks or commercial space produced by the development.

Development projects

First, you need to know that there are different financial considerations for a developer and a development project:

- Developer: A business in its own right; it has costs and overheads just like any other business, and it seeks to generate income greater than its costs to generate a profit. It does this by undertaking development projects.

- Development project: A financial entity. You should view it as a financial project – it is a series of costs and incomes over time that generates a profit by developing a specific parcel of land.

How a developer manages the financial interplay between their costs and revenues, depends on the type of development they do, the level of risk involved, and their sources of capital.

A development project is a separate legal entity created to develop a parcel of land into a new residential development. This legal entity will ultimately be broken up into a series of smaller legal entities which will be sold (i.e., the new homes or apartments).

Developers generate returns by managing their costs. Among these costs are the overheads to run their business. The profit, referred to as 'development profit', is the return a developer seeks to:

- Account for the capital they have put 'at risk' to employ staff and operate premises, etc.;

- Pay overheads to purchase land; and

- Cover their finance costs, the costs of building materials, and professional costs associated with building and selling the development.

Development profit and the profits of a developer are not the same thing. The profit a developer generates is the income less costs they achieve from undertaking a series of different developments – which all generate an individual development profit. The development profit is an outcome of the development itself, so while it can be assumed or 'guesstimated', it will not be known until the end of the project.

Development is a series of risks

Development is more complex than the simple model outlined above. Development is a series of risks. The developer manages these risks to deliver the development profit.

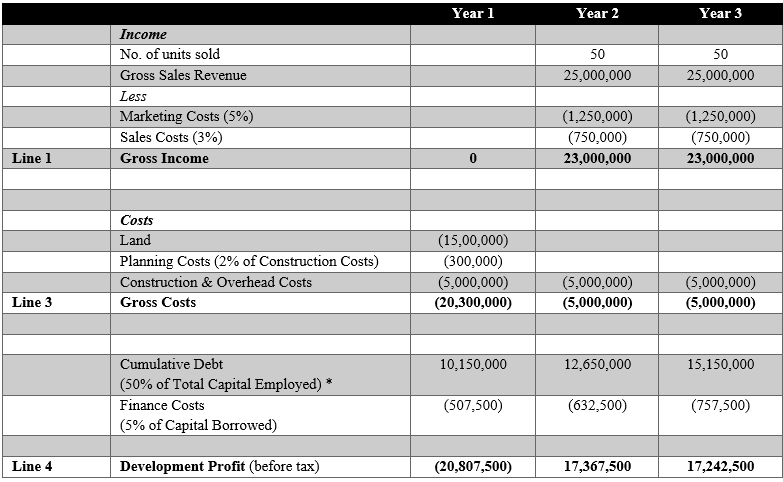

The developer's development profit is the 'GDV' less the cost of the risks associated with developing and selling the development. Think of it like this:

Gross Development Value, less

- Land risk: Cost of buying the land

- Planning risk: Cost of obtaining consent

- Construction risk: Cost of any demolition works and building a new building

- Sales risk: Cost of marketing and selling the development

- Finance risk: Cost of the capital employed for the development

= Development Profit

So, the model can then be re-adjusted to that shown in the following table:

Table 2.2: Kingsley Tower, development cash flow

* For simplicity, I have assumed that none of the debt is extinguished until the end of the development.

You will notice that with the addition of all these costs, the developer’s income has fallen from £20,000,0000 to £13,802,500.

This is a simple model to illustrate the process, but of course the reality is far more complex and would also consider the following:

- Accounting differences: From an accounting perspective, the income would not be recognised at the same time the cash was spent;

- Debt: Would be extinguished throughout the development process.

Developers constantly battle to acquire land and take it through the planning process, build the development, and sell it as quickly as possible at the highest price possible to generate the highest possible profit. In going through these steps, the developer manages a series of risks to achieve their profit. So, therefore:

- The more a developer underestimates those risks, the more it will cost to build the development and the lower their total profit will be.

- The better a developer can manage those risks, the lower their costs, and therefore the higher their total profit will be.

So, how do these risks work? It is important to understand that there are risks associated with the project itself, and then there are also all the other risks companies have to manage in owning and operating their business.

By

By