New Build Investment Property Masterclass: Chapter 17 - Development is a series of risks (financial risk)

Development is a series of risks

Development is a series of risks. The developer manages these risks to deliver the development profit.

The developer's development profit is the 'GDV' less the cost of the risks associated with developing and selling the development. Think of it like this:

Gross Development Value, less

- Land risk: Cost of buying the land

- Planning risk: Cost of obtaining consent

- Construction risk: Cost of any demolition works and building a new building

- Sales risk: Cost of marketing and selling the development

- Finance risk: Cost of the capital employed for the development

= Development Profit

Financial risk

When you think about financial risk, two considerations drive risk and therefore, behaviour:

- Corporate Structure – how a developer’s company is structured will impact their decision making.

- Developer Funding – at a project level, how debt will drive specific behaviour.

Corporate structure

From a corporate structure perspective, developers fall into two broad categories:

- Listed Developers

- Private Developers

The distinction between the two is how they raise and use capital for development and to run their company, which impacts the pressure they face when they deploy and use that capital.

How listed developers fund developments

Listed developers are listed on a stock exchange, which means that they are regulated and have specific requirements over and above those of private developers. Many of these relate to transparency about their activities and the need to report their business activities and financial results.

It is much easier for these listed developers to raise capital, and their primary form of capital comes from the shareholders who own their shares via a publicly traded market. These companies are restricted in the sort of activities they can undertake, as their shareholders have purchased their shares because they want to have financial exposure to a specific sector or part of the economy.

Generally, these companies fund their developments through a central treasury function. The role of a central treasury is to raise capital for the company’s use from a variety of sources, which include:

- Shareholder Equity – Stocks and Shares;

- Corporate Bonds – long term loans; and

- Senior Debt Facilities – sometimes referred to as a revolving credit facility.

Listed developers generally do not raise capital for each specific development they are engaged in. They simply use their centrally generated capital to deploy within their business for development projects. This capital is deployed to different business units to use when they identify development projects which they anticipate will generate profits in line with their expectations.

These developers’ target rate of return is linked to how much income their capital (shareholders and debt) expects to receive based on the given risk they are taking. Their primary consideration is their weighted cost of capital (WACC).

When creditors and owners invest in a business, they incur an opportunity cost that is equal to the returns they could have earned from alternative, similar-risk investments. Together, these opportunity costs define the minimum rate of return which the company must earn to meet the expectations of its capital providers. This is the firm's cost of capital.

The WACC is its weighted average cost of capital – it is a way of measuring its return expectations for all its capital, rather than just its debt (i.e., of considering the return expectations of its shareholders).

How private developers fund developments

Private developers raise and allocate capital differently from listed developers. Unlike listed developers, which have the luxury of being able to easily raise capital from their shareholders and other lower costs of debt, they are not able to allocate capital to different business units to ‘draw down’ as and when it is required.

Instead, they raise and deploy capital on a project-by-project basis. Every time they source a project for potential development, they have to seek equity (or use their own) together with debt to fund the development.

Why does it matter how the developer is funded?

It is important to understand the differences between the two operational models, as they have significant implications for the way the respective types of developer track their financial performance, and more importantly, the way they behave. Let me explain why.

Listed developers

Listed developers do not have as many issues concerning raising capital to employ in projects. They will look at their business as a company that is simply making a product and taking it to market. Whilst there is no doubt they will be interested in specific projects' financial performance, they will generally have a significant amount of work in progress (WIP) across several schemes or larger projects.

They will be most concerned about how their shareholders and the share market view their financial performance. Their issues will be balancing the capital they have employed to purchase various assets and the return they can generate. The metrics they will primarily be concerned about will be as follows:

Average Selling Price (ASP)

This is the average selling price of each property. This will be a function of market prices, but will also be impacted by the mix of product they sell, and the locations of the properties they sell.

Cost of land

A key determinant of profit, as in downturns developers seek to build their land bank of property without planning permission (i.e., land banking) because the costs of buying land are much lower.

Build costs & overheads

The cost of both wages and materials employed by the company in development.

Number of properties sold

How many properties they are producing and selling over a given period.

Return on Capital Employed (ROCE)

ROCE is a common measure of financial performance for listed entities. It is a financial ratio that determines a company’s profitability and the efficiency of the capital (debt & shareholder equity) in their core activities. ROCE is expressed as a percentage, and is calculated as follows:

Operating Profit / Total Equity + Non-Current Liabilities x 100

ROCE is used as a key measure for several reasons:

- It is an easy way to evaluate the overall financial performance of a business.

- It is an easy way to benchmark a company against its competitors (i.e., if you compare two companies in the same industry and one has a ROCE of 22% and the other has a ROCE of 15%, then that means the first company is generating a greater return than the second, and is more efficiently using its capital).

- ROCE is therefore a good measure for companies to use when evaluating whether or not to take on individual development - they know if a project generates a return that is lower than their ROCE, it will weaken their financial performance.

- ROCE is commonly used because it is an easy calculation for listed companies to make. The information required to undertake the calculation is published in a company’s financial statements. This is an important factor, because this data is a ‘snapshot’ of the company’s financial performance on a given day (i.e., the day its financial statements are produced). Therefore, companies which track ROCE will be very interested in achieving sales on and before key dates – these will be the quarter days and at the end of their financial year (more on this point in Part 5: Your property investment strategy).

Operating profit (headline margin)

Operating profit or earnings before interest and tax (EBIT) margin is a key measure for companies, as the percentage of turnover turned into profit.

Private developers

Private developers’ decision-making is different. These companies place far greater importance on the specific financial performance of each individual project, because most do not raise capital to fund their business operations. Instead, they raise capital for deployment on specific projects.

For these companies, the structure of their debt for projects is likely to be far more complex (i.e., several ‘layers of debt’), with a series of different obligations and requirements to the providers of the debt. These companies will be far more focused on paying off specific debt obligations and driving their financial performance by clever management of debt and specific equity provisions such as preferred equity.

Internal rate of return

A final common measure of project performance likely to be used by developers is the project's internal rate of return (IRR). The IRR is a metric used to estimate the profitability of potential investments. The internal rate of return is a discount rate which makes the net present value (NPV) of all cash flows from a particular project equal to zero.

Typically, the higher the project's IRR, the more desirable it is for the developer to undertake it. If the IRR is negative or below their target return, then this implies that the developer was losing money, because the rate of return from the project is apparently less than the cost of the capital used to undertake the development.

A developer will then assess the quality of a particular development opportunity by how much return it generates as a percentage. Therefore, for a listed company, if the IRR is greater than its WACC, the difference is profit. Meanwhile, for a private developer, if their IRR is greater than their cost of debt and any preferred equity, the difference is profit.

Developer funding

Funding is the oxygen which allows a development to take place. In most scenarios, developers will need to use a significant amount of debt to fund construction, and potentially also to purchase the land upon which the development is to be built.

Debt is a double-edged sword: it creates the funding required to bring a development to life, but it also creates an obligation to a third party to which interest is paid, as well as the capital borrowed in the first place. In addition to the cost pressure debt creates is the time pressure it creates. By accepting debt, developers create a pressure to rapidly deliver income through sales in order to begin to repay the debt.

The two principles of debt

Whilst the way different developers behave will vary depending on how they are structured, the way they use their capital structure within developments is similar. All developers have the same fundamental objective: to employ capital to purchase land, deliver a ‘development’, and derive a development profit from selling the newly-developed housing.

When you think of capital funding, specifically debt, you just need to remember two basic principles:

- Debt has a cost associated with time; and

- Debt has a cost relative to its specific risk (the ‘Risk Premium’).

It does not matter how complex someone tries to make debt sound - these are the two principles that drive the behaviour of debt.

The time cost of debt

When you think of this capital, you need to think of it in the same way as any other resource. Take for example an employee, who comes to work, undertakes activities, and are paid a wage for the work they do. The more productive a company can make an employee, the less time they will need to spend doing an activity, and thus, the lower the wages the company will need to pay if the price of the product remains the same. Then, the company will derive the same income from a lower input of costs and their profits will increase.

Capital has the same qualities. Equity and debt providers provide capital to developers so they can undertake developments, and for this they receive compensation in the form of dividends (equity providers) or interest (debt providers). Therefore, the less time a developer needs to use debt, the lower their interest payments because they are not using the funds for as long.

Risk premium attached to debt

The interest that a lender charges is related to the risk they are taking. All interest rates are comprised of three elements:

- Risk-free rate: The theoretical rate of return an investor will expect to receive from a risk-free investment over a specific period.

- Inflation premium: The compensation for the declining purchasing power of their capital (i.e., the rate of inflation).

- Risk premium: How much compensation the investor expects to receive from this specific investment (sometimes referred to as systematic risk).

The risk-free rate and inflation premium are relatively static, so it is only really the third component, the risk premium, which the provider of the debt will have any real input over. And for this provider, the risk they are taking will be related to several factors:

- How long will the project take?

- How much risk is there in that specific market?

- How much protection do they have in the situation of default? This is referred to as debt priority, i.e., where do they rank in terms of being paid back if the developer defaults?

By applying these concepts, a developer will use debt to fund their construction. However, because debt providers do not typically want to take the full risk for a particular development, they will take different levels of risk depending on their risk appetite and how much return they seek for that risk (the risk premium).

Types of debt

Debt is provided in three principal forms:

Senior debt

Senior debt is the cheapest form of financing of both debt and equity. Interest rates and terms vary for senior debt, but will generally be in the mid-single-digit range. While this type of debt is cheap, it also comes with some stipulations:

- For non-listed developers, this will typically be some form of collateral, such as a personal guarantee from the owner. Likewise, for private developers, senior debt will be more expensive than for listed developers because the risk is higher.

- For listed developers, stipulations are likely to be linked to their key financial metrics and share price. If these key financial metrics fall below pre-agreed levels, then they will be in breach of the covenants of their debt and will be required to resolve these issues. Otherwise, there will be mechanisms either to call the debt in, or more likely increase the cost of the debt to account for the increased risk.

Mezzanine debt

Many smaller developerswill not be able to raise enough debt to meet their funding requirements from senior debt alone. For these developers, mezzanine debt will be an option to ‘bridge’ their debt requirements, often referred to as a bridging loan. Mezzanine debt is an expensive form of debt, usually with an interest rate in the low to mid-teens. The reason mezzanine debt is more expensive is because the lender does not have as much security as a senior debt provider.

Preferred equity

Preferred equity is quasi-debt, sometimes referred to as a hybrid because it has qualities of both debt and equity. Raising debt is generally tied to how much collateral (equity) the developer is putting at risk, and in some scenarios the developer will not have the ability to raise enough equity by themselves and will therefore use preferred equity.

This preferred equity will be secured to invest in the development; it is generally considered cheap debt because there is no immediate requirement to repay it. However, in the long-term, equity is the most expensive option because the developer will have to give away a substantial amount of their profit in return for it. At the end of the development, the preferred equity will take its return after all debt has been extinguished, but before the developer receives their profit.

Common equity

Common equity is the amount that all shareholders have invested in a company. This includes the value of the shares themselves.

Capital stack

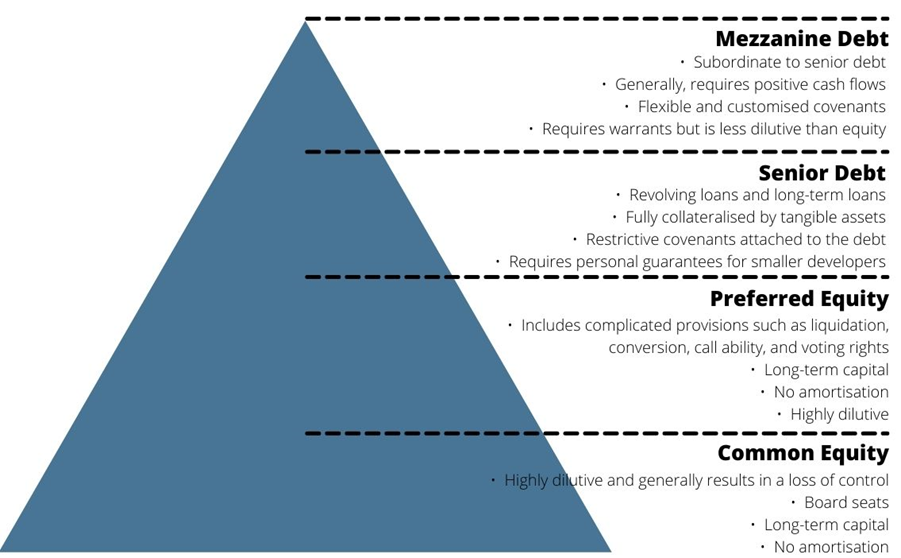

The different forms of debt and equity sit in what is referred to as a Capital Stack, representing the combinations of the different sources of debt and equity employed by the business.

Figure 2.2: Typical capital stack

For a developer to generate the greatest possible profit, they need to use the cheapest forms of capital available, and to deploy them for the shortest period.

What this means is that a developer will evaluate a project in the form of a financial cash flow, to set out all the cash flows they anticipate being associated with the project. These will include:

- Revenue: Income from sales less sales costs;

- Costs: Land, materials, and labour.

This will generate a capital requirement to fund the difference between the revenue and costs. This cash requirement will need to be funded by the capital stack.

From a financial perspective, a developer can best manage their Capital Stack by:

- Using as much debt as possible – because debt is cheaper than equity;

- Using as much long-term debt as possible – senior debt is cheaper than mezzanine debt; and

- Avoiding outside sources of equity.

Practical application of debt and equity

Turning attention back to the two development companies I introduced earlier, Ashley’s Homes and Osborne Corporation, and looking now at their respective approaches to the development of Kingsley Tower from a funding perspective, each will have different objectives.

Osborne Corporation

Osborne Corporation are centrally funded. The capital employed for development is likely to be a small part of a much larger pool of capital. Their primary sources of funding are likely to be:

- Shareholder Equity – expensive capital;

- Revolving Long-Term Debt (Senior Debt) – the lowest cost capital.

They are not likely to be under significant pressure from their providers of debt, and the cost of that debt will be low relative to Ashley’s Homes. Their principal concerns with Kingsley Tower from a funding perspective will be:

- What is the anticipated return and what impact will it have on its ROCE?

- How much capital will be tied up from the debt facility and where could it have been used elsewhere?

- How long will it take to get the capital back?

- How much is the Average Selling Price, and what impact will it have on the overall metric?

- How will owning the land impact the Balance Sheet? If it is a significant cost relative to their overall assets on the balance sheet, what impact might this have on the cost of debt?

From a sales perspective, their sales pressures will most likely be:

- How many sales do they need to achieve to hit their initial pre-sale target?

- Beyond selling these initial pre-sales, there may be more pressure on maintaining prices rather than discounting in order to simply sell the remaining apartments.

Where their sales pressures are likely to exist will be:

- Recording sales before key financial dates such as quarterly, half-year, and full-year reporting dates – in order to be able to report sales positions in their financial accounts.

- Once projects are complete, ensuring all apartments are sold to ensure that they can record sales, and collect and recognise their revenue.

Osborne Corporation is likely to look at Kingsley Tower from the perspective of the development in the context of their broader company and operations, rather than focusing specifically on the development as a standalone development.

Ashley Homes

For Ashley’s Homes, the situation is quite different. They raise capital specifically for each development, and their funding is more likely to come from the following sources:

- Their own equity;

- Senior debt – likely at a higher cost than Osborne Corporation.

Additionally, where they cannot raise enough capital to fund projects from these sources, they are likely to use higher-cost capital from the following sources:

- Preferred equity: Additional capital providers, these private funding sources will not invest in Ashley’s Homes, but will provide equity in the development itself. This will mean that Ashley’s Homes can take on larger projects, but to do so, they will have to pay a third party out of the profits from the development before they pay themselves.

- Mezzanine debt: As this is an expensive form of short-term debt, the risk to Ashley’s Homes arises if the costs of using this debt outweigh the benefits. For example, if the debt is only needed for a short time it will most likely be cheaper than using preferred equity, and therefore, they will be able to keep more profit to themselves. However, if they end up needing that debt for longer than anticipated, then they may simply run out of money.

Ashley’s Homes are unlikely to be concerned about how the development of Kingsley Tower impacts their average selling price. They are likely to be far more interested in the specific return of the project and how quickly they can get capital in from sales and reduce their debt requirements.

The clever management of their debt will be one of the key factors which determine their profitability, rather than specific sales rates. Ashley’s Homes will most likely be driven by two specific sales milestones:

- Undertake enough pre-sales to meet initial debt requirements; and then

- Continue selling as quickly as possible to ensure that they can recoup capital as quickly as possible.

Risks associated with development funding

There are several risks associated with development funding, most of which are relatively obvious:

- Interest costs: The cost of debt is essentially a ticking clock. For a developer, if their interest costs are too high then there is a risk that the cost of interest will simply erode the return generated by the development.

- Additional costs due to time over run: Construction delays or delays in selling and completing the sales that have been exchanged will extend the project's life. This will also extend the time debt required, thereby increasing their finance costs and reducing their profit.

- Not meeting sales targets and inability to draw down debt: If a developer cannot sell enough property at the early stages of their development, then they will not be able to access their debt and commence construction.

- Failed completions: If sales fail to complete, this will add additional time to re-sell those properties, and will mean the developer needs to utilise their debt for a longer period. This will increase their costs of funding and reduce their returns.

- Cost escalations: Increases in costs in areas such as marketing, sales, planning, and construction will all require additional capital, increasing the cost of debt and reducing returns.

- Change in market conditions impacting debt covenants: If market conditions deteriorate, a developer’s land value will reduce, as will the anticipated return for unsold properties. This can potentially trigger a breach of covenant conditions – increasing the risk to debt providers, and increasing debt costs.

By

By