New Build Investment Property Masterclass: Chapter 6 - Length of the market cycle

Over the past 60 years in the UK, it has taken between three years and 17+ years for house prices to double. There is little to show in terms of a pattern in time in which the market moves.

And guess what? It does not matter how long the market cycle is. You are never going to identify the absolute bottom of the property market cycle. And even if you could, would you wait for years to buy a property just because you wanted to buy at the bottom of the cycle?

The most important thing is to understand that the market moves in cycles, and to recognise what point of the cycle you are in, and bear this in mind when you are buying.

You will often hear people refer to the length of the market cycle. People will talk about the market moving in a 7-year cycle or an 18-year cycle. The reality is that there is little evidence to support any definitive time period; it is simply true to say that the market moves in cycles, and that those cycles have the characteristics set out above.

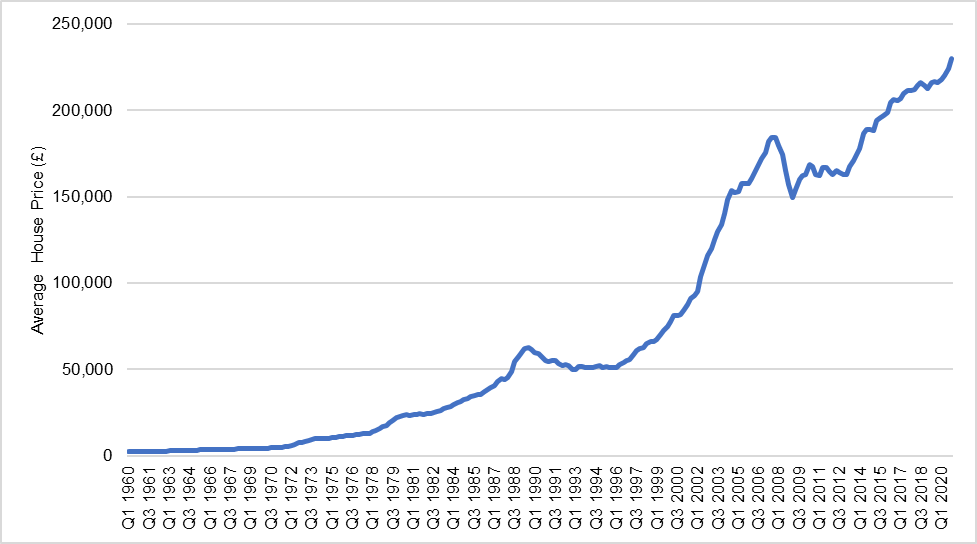

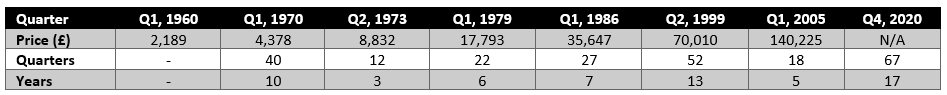

The easiest way for me to demonstrate this to you is to show you the average house prices in the UK for new-build property between 1960 and 2020.

Figure 1.2: UK Nationwide House Price Index 1960–2020

Now, let's look at what happened. How long did it take for UK house prices to double?

Over the past 60 years in the UK, it has taken between three years and 17+ years for house prices to double. There is little to show in terms of a pattern in time in which the market moves.

And guess what? It does not matter how long the market cycle is. You are never going to identify the absolute bottom of the property market cycle. And even if you could, would you wait for years to buy a property just because you wanted to buy at the bottom of the cycle?

The most important thing is to understand that the market moves in cycles, and to recognise what point of the cycle you are in, and bear this in mind when you are buying. By

By